To resolve Title loan complaints, gather comprehensive evidence including loan docs, correspondence, and visuals to expose misrepresented terms, hidden fees, or unfair practices. Organize and label evidence, demonstrating financial impact compared to industry standards. For Houston or Motorcycle Title Loans, meticulously document interactions, interest rates, and collateral value to address repossession concerns and prove compliance with agreed terms.

Title loan complaints can be powerful tools for consumers seeking justice, but they require solid proof. This article guides you through strengthening your title loan disputes with compelling evidence. Learn how to gather and organize documentation effectively, addressing common issues head-on. We’ll walk you through the process, from collecting relevant papers to presenting a robust case, ensuring your voice is heard and rights protected in navigating title loan complaints.

- Gather Compelling Evidence for Title Loan Complaints

- Organize and Present Proof Effectively

- Address Common Issues With Strong Documentation

Gather Compelling Evidence for Title Loan Complaints

When addressing Title loan complaints, having concrete evidence is paramount to strengthen your case and ensure a fair resolution. Gather detailed records of all interactions with the lender, including loan agreements, correspondence via email or mail, and any documentation related to repayments or default. For instance, if you’re considering a Truck Title Loan, it’s crucial to retain copies of the title transfer documents and log all transactions.

Additionally, compile evidence that highlights any discrepancies in repayment options or loan extension policies advertised by the lender versus what you actually experienced. This may include late fee notices, communications regarding loan terms, and any attempts made to resolve issues amicably. Such comprehensive documentation will not only bolster your complaint but also demonstrate a pattern of unfair practices if multiple borrowers share similar experiences.

Organize and Present Proof Effectively

When presenting proof to support your Title loan complaints, organization is key. Structure your evidence logically and clearly, ensuring each point directly addresses an aspect of your grievance. Start by compiling all relevant documents, such as loan agreements, interest calculation statements, and any correspondence with the lender. Categorize this documentation into clear sections that correspond to your concerns—for instance, misrepresented terms, hidden fees, or unfair interest rates. This systematic approach makes it easier for you to make your case and allows the lender to understand the specific issues you’re raising.

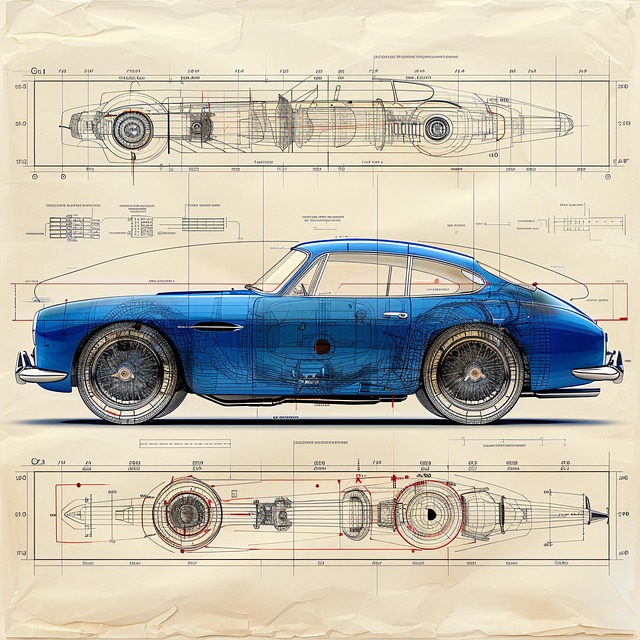

Once organized, present your proof in a concise and understandable manner. Use visuals where applicable, like charts or graphs, to illustrate discrepancies in interest charges or loan terms. Clearly label each piece of evidence and provide brief explanations linking them to your Title loan complaints. For instance, if challenging high-interest rates, show calculations comparing these rates to industry standards or previous agreements. Emphasize the impact of these rates on your financial situation, highlighting how they differ from initially promised terms—a crucial aspect in navigating a financial solution. Remember, presenting your proof effectively is about telling a compelling story that demonstrates why keeping your vehicle should not come at an unfair cost through excessive interest rates.

Address Common Issues With Strong Documentation

When addressing Title loan complaints, one of the most effective strategies is to present robust documentation that highlights and rectifies common issues. Many borrowers face challenges such as unclear terms, hidden fees, or disputes over the vehicle’s value. By gathering and organizing comprehensive evidence, you can bolster your case and demonstrate a clear understanding of both the loan agreement and your rights.

For instance, if you’ve taken out a Houston Title Loan or a Motorcycle Title Loan, ensure you have detailed records of all interactions with the lender, including loan documents, interest rate breakdowns, and any additional charges. Keep Your Vehicle as collateral is a significant aspect often emphasized in such loans, so proving that you remain in compliance with the terms can help resolve complaints related to repossession or vehicle retention.

By gathering compelling evidence, organizing it effectively, and addressing common issues with strong documentation, you can significantly strengthen your title loan complaints. This ensures that your voice is heard and your concerns are taken seriously, leading to better outcomes and a more transparent lending environment. Remember, thorough and well-presented proof is key when navigating title loan controversies.